nc estimated tax payment calculator

PO Box 25000 Raleigh NC 27640. Individual Income Tax Sales and Use Tax Withholding Tax.

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

North Carolina Income Tax Calculator 2021.

. This saves you from having to submit payments yourself. Home File Pay Taxes Forms Taxes Forms. If you make 70000 a year living in the region of North Carolina USA you will be taxed 11498.

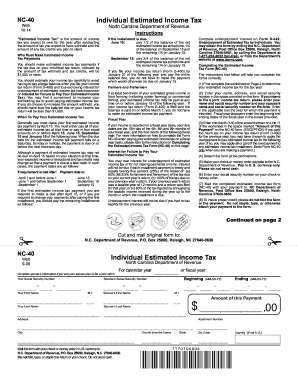

Find out how much youll pay in North Carolina state income taxes given your annual income. How To Pay Estimated Taxes. 2022 NC-40 Individual Estimated Income Tax.

Individual Income Tax Sales. After a few seconds you will be provided with a full. Want to schedule all four payments.

Beginning July 1 2022 the applicable rate is 2 percent 2 for each. Make one payment or. Your average tax rate is 1198 and your.

The calculator should not. To pay individual estimated income tax. If you make 70000 a year living in the region of North Carolina USA you will be taxed 11498.

File Pay Taxes Forms Taxes Forms. The North Carolina Tax Calculator. Overview of North Carolina Taxes.

This calculator is designed to estimate the county vehicle property tax for your vehicle. Customize using your filing status deductions exemptions and more. North Carolina Gas Tax.

Schedule payments up to 60 days in advance. File Pay Taxes Forms Taxes Forms. The average effective property tax rate in North Carolina.

Just enter the wages tax withholdings and other information required. WASHINGTON The Internal Revenue Service today reminds taxpayers who requested an extension to file their 2021 tax return to do so by Monday October 17. PO Box 25000 Raleigh NC.

To use our North Carolina Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. View the North Carolina property. The estimated tax you will pay.

For example if the results from this calculator tell you to pay 1200 quarterly have your employer increase your withholding by. North Carolina Department of Revenue. Prepare Pay Taxes.

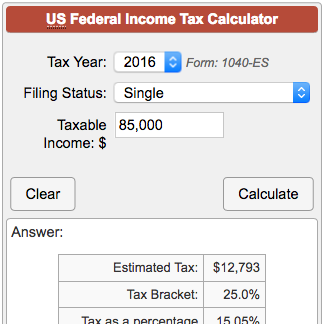

Your household income location filing status and number of personal exemptions. Our income tax calculator calculates your federal state and local taxes based on several key inputs. You may send estimated tax payments with Form 1040-ES by mail or you can pay online by phone or from your mobile device using the IRS2Go app.

Individual Income Tax Sales and Use Tax Withholding Tax. Abroad Tax Return. North Carolinas property tax rates are relatively low in comparison to those of other states.

The act went into full effect in 2014 but before then North Carolina had. Use ADPs North Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. You can also pay your.

Please enter the following information to view an estimated property tax. From January 1 2022 through June 30 2022 the applicable rate is 10 percent 10 regardless of how late the tax is paid. In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes.

North Carolina Department of Revenue. North Carolina DMV fees are about 585 on a 39750 vehicle based on 108 in registration fees plus a vehicle property tax that varies by weight and location. Pay individual estimated income tax.

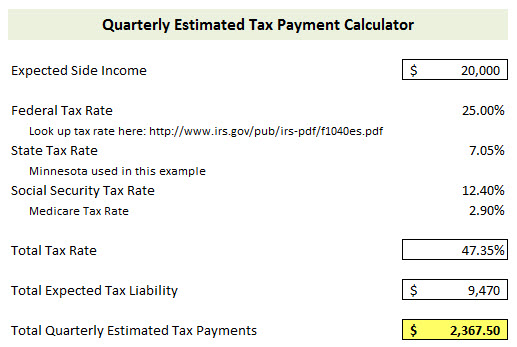

To calculate your estimated taxes you will add up your total tax liability for the current yearincluding self-employment tax individual income tax and any other taxesand divide.

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Free North Carolina Payroll Calculator 2022 Nc Tax Rates Onpay

Quarterly Estimated Tax Payments Who Needs To Pay When And Why

Mortgage Calculator Pmi Interest And Taxes Smartasset

North Carolina Estimated Tax Payments Form Fill Out And Sign Printable Pdf Template Signnow

Tax Calculator Estimate Your Taxes And Refund For Free

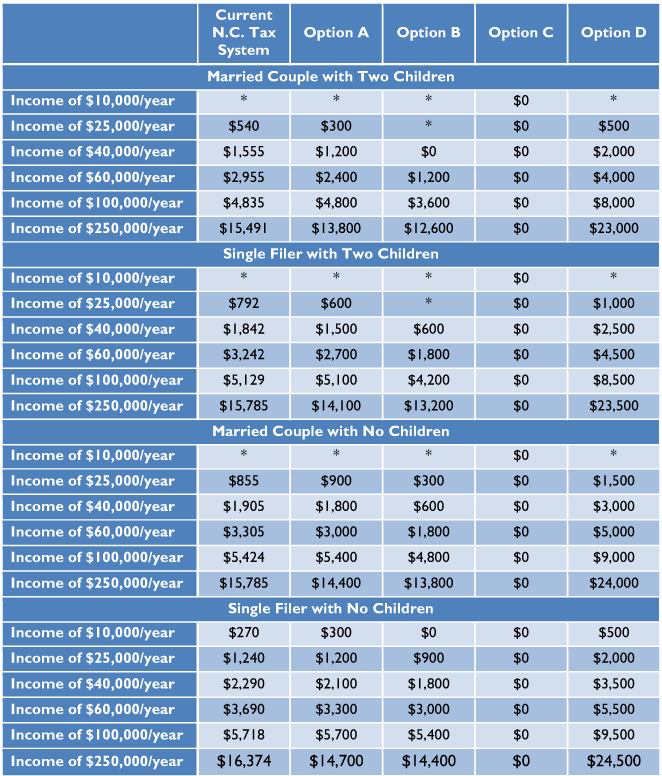

North Carolina Tax Reform Options A Guide To Fair Simple Pro Growth Reform Tax Foundation

Estimated Tax Payments Are Due Today Who Needs To File How To Submit And More Cnet

How To Calculate And Pay Quarterly Estimated Taxes Young Adult Money

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

Payroll Tax Calculator For Employers Gusto

Tax Withholding For Pensions And Social Security Sensible Money

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Llc Tax Calculator Definitive Small Business Tax Estimator

Student Loan Forgiveness Is Taxable Income In North Carolina Wfmynews2 Com